“You can search throughout the entire universe for someone who is more deserving of your love and affection than you are yourself, and that person is not to be found anywhere. You yourself, as much as anybody in the entire universe deserve your love and affection.” ― Buddha

What are you missing? See the Latest Mainstream News next to Citizen Journalists and Trending Internet Theories. We recognize that there is an abundance of information and theories out there, and that conflicting views need to be presented side-by-side in order to try and find the theme behind them. Even though we like to keep things lighthearted, we are very serious about bringing transparency to the media (all news, including the fringe stuff).

Sign up for a LOBSTR wallet

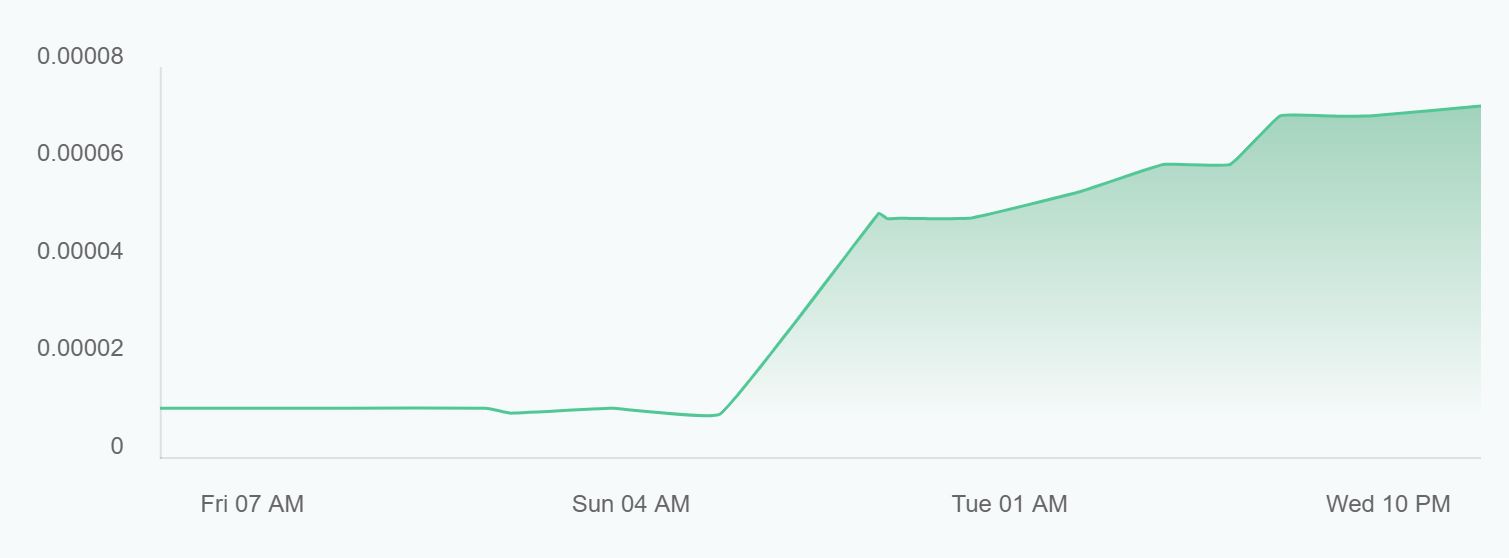

Create an account and use the code (IBHCMSVHI). Purchase or transfer Stellar Lumens (XLM) into the app. Then add the asset "BULLETS" (bullets.tomlhosting.com). Swap XLM for BULLETS using the swap asset or trade functions. E-mail feed at bullshift.news your stellar address, and the Bull will send you some BULL-E-TOKENS for free.

Sign up for a LOBSTR wallet

Create an account and use the code (IBHCMSVHI). Purchase or transfer Stellar Lumens (XLM) into the app. Then add the asset "BULLETS" (bullets.tomlhosting.com). Swap XLM for BULLETS using the swap asset or trade functions. E-mail feed at bullshift.news your stellar address, and the Bull will send you some BULL-E-TOKENS for free. Dr. Anthony Fauci is admitting that the coronavirus could have come from a “lab leak” — as emails released through the FOIA show he was told of “unusual features of the virus” at the beginning of the pandemic — but is blaming criticism of his shifting positions on “people out there” who “resent” him. Fauci finally admits COVID-19 may have come from a ‘lab leak’ after his emails exposed...

A Chinese virologist who was among the first people to tout the Wuhan lab theory said the coronavirus is a bioweapon and Dr. Anthony Fauci was among the scientists and organizations who knew about it and tried to hide it Chinese virologist who was among first to tout Wuhan lab theory says Fauci's emails back up what she's been saying all along - the coronavirus is 'an unrestricted bioweapon' - and ...

See the full collection of articles and the emails.

Fauci Emails sectrion on COVID Special Report

Dr. Anthony Fauci is admitting that the coronavirus could have come from a “lab leak” — as emails released through the FOIA show he was told of “unusual features of the virus” at the beginning of the pandemic — but is blaming criticism of his shifting positions on “people out there” who “resent” him. Fauci finally admits COVID-19 may have come from a ‘lab leak’ after his emails exposed...

A Chinese virologist who was among the first people to tout the Wuhan lab theory said the coronavirus is a bioweapon and Dr. Anthony Fauci was among the scientists and organizations who knew about it and tried to hide it Chinese virologist who was among first to tout Wuhan lab theory says Fauci's emails back up what she's been saying all along - the coronavirus is 'an unrestricted bioweapon' - and ...

See the full collection of articles and the emails.

Fauci Emails sectrion on COVID Special Report